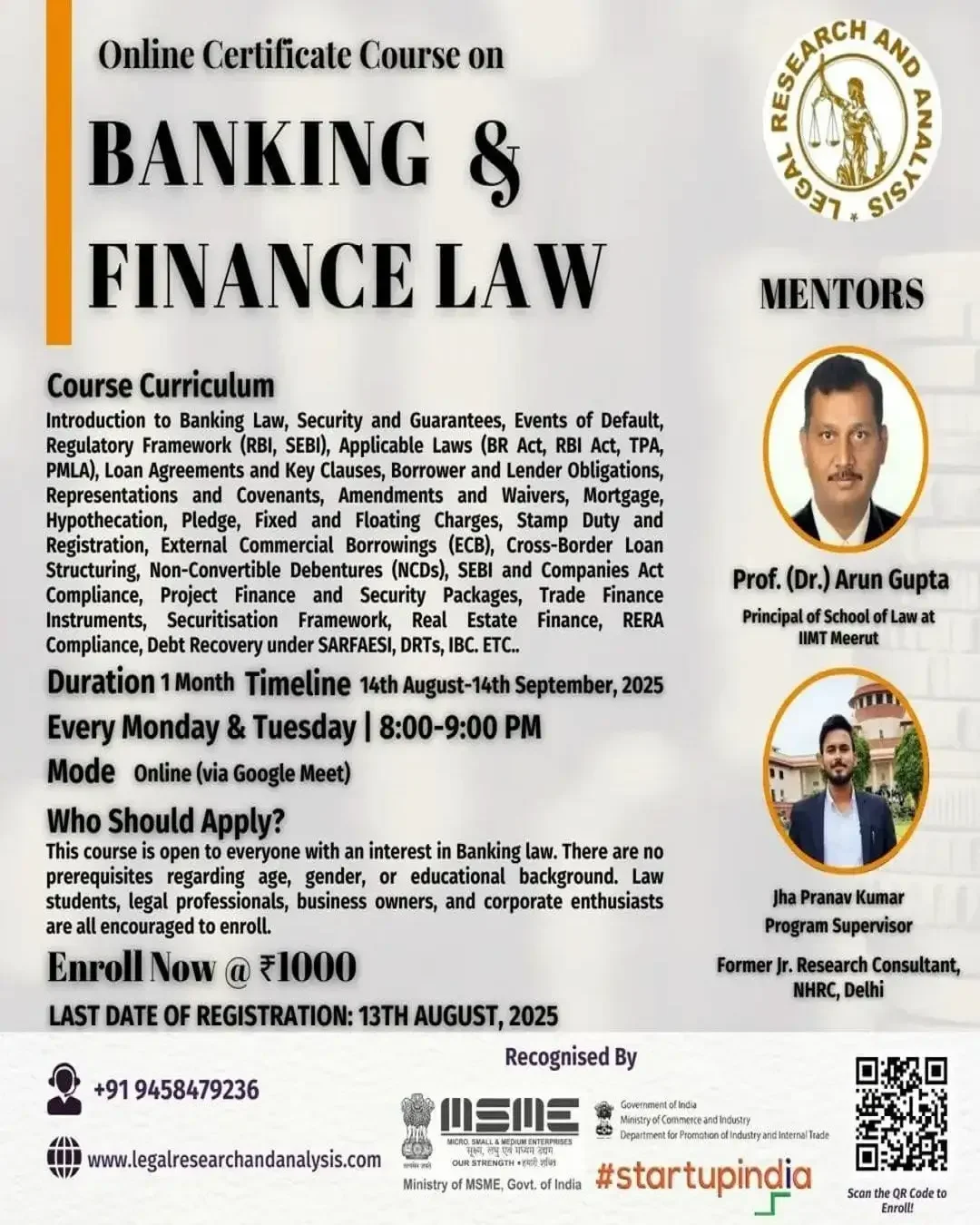

CERTIFICATE COURSE ON BANKING AND FINANCE LAW

4.8 (461 Rating)

₹1000

Schedule

- Duration: 1 Month

- Frequency: Two classes per week

- Total No. of Classes: 10

Important Dates

- Last Date to Apply: 13-Aug-2025

- Course Start Date: 14-Aug-2025

- Course End Date: 14-Sep-2025

About The Course

The Certificate Course on Banking and Finance Laws is a comprehensive four-week online program designed to equip students and professionals with a practical understanding of the legal and regulatory framework that governs banking and financial transactions in India and abroad. Through 8 intensive sessions, the course bridges theoretical concepts with real-world application, offering a holistic perspective on key topics including loan structuring, security creation, project finance, trade finance, external commercial borrowings (ECBs), non-convertible debentures (NCDs), securitisation, and real estate finance.

Comprehensive 4-Week Program: Structured into 8 intensive classes covering key legal, regulatory, and practical aspects of banking and financial transactions.

Foundational to Advanced Legal Concepts: Covers core topics such as loan agreements, security creation, ECBs, project finance, NCDs, trade finance, securitisation, and real estate finance.

Practical Transactional Insights: Designed to provide real-world exposure to financial documents, negotiation strategies, regulatory filings, and enforcement mechanisms.

Practical Transactional Insights: Designed to provide real-world exposure to financial documents, negotiation strategies, regulatory filings, and enforcement mechanisms.

Integrated Legal Framework: In-depth discussion of relevant Indian laws (RBI Act, Banking Regulation Act, SARFAESI, FEMA, IBC, SEBI Regulations) and international norms (Basel, FATF).

Drafting & Negotiation Focus: Focused sessions on loan documentation, security agreements, and key clauses (Representations, Covenants, Events of Default, Boilerplates).

Career-Oriented Learning: Ideal for law students, young professionals, CS/CA aspirants, in-house counsels, and anyone interested in banking, finance, or corporate law.

Eligibility

This course is open to everyone with an interest in corporate law. There are no prerequisites regarding age, gender, or educational background. Law students, legal professionals, business owners, and corporate enthusiasts are all encouraged to enroll.

Aim

Comprehensive Understanding: Equip participants with an in-depth grasp of corporate law principles.

Practical Skills: Apply corporate law concepts to real-life business scenarios.

Professional Development: Enhance participants’ legal expertise for advanced career roles in corporate sectors.

Trend Awareness: Keep participants updated with the latest in corporate law, especially technology-driven changes such as blockchain.

Course Format

- Live Sessions: Interactive webinars with expert faculty.

- Recorded Lectures: Accessible anytime for flexible learning.

- Case Studies: Real-world scenarios for practical application.

- Assessments: Quizzes and assignments to reinforce learning.

- Certificate: Upon successful completion.

Importance of the Course

The Online Certificate Course in Corporate Law is essential for anyone looking to advance their career in the legal or corporate sectors. It provides a comprehensive understanding of corporate law principles, covering key topics such as company formation, governance, finance, compliance, and emerging trends like blockchain and smart contracts. The course combines theoretical knowledge with practical application through case studies and interactive sessions, ensuring participants can handle real-world scenarios. With flexible online learning and a certification upon completion, this course enhances their professional credentials and prepares them for advanced roles in the corporate legal landscape.

Objectives of the Course

- To provide foundational knowledge of banking and financial systems, including types of loans, securities, and financial instruments.

- To enable participants to interpret and analyze key financial documents such as loan agreements, debenture deeds, and security creation instruments.

- To familiarize learners with the applicable legal framework, including the Banking Regulation Act, RBI Act, SARFAESI Act, FEMA, SEBI regulations, and IBC.

- To introduce practical insights into financing transactions including project finance, trade finance, external commercial borrowings (ECBs), and securitization.

- To develop skills for identifying risks and legal issues in banking documentation and suggest appropriate legal and commercial remedies.

- To explain the role of regulatory authorities like the Reserve Bank of India, SEBI, and Ministry of Finance in supervising banking transactions.

- To equip learners with knowledge of cross-border financial laws, including ECB frameworks, foreign investments, and international lending norms.

- To provide exposure to dispute resolution mechanisms including enforcement under SARFAESI, insolvency proceedings under IBC, and recovery via DRTs.

- To prepare participants for real-world legal and compliance roles in law firms, banks, financial institutions, or regulatory bodies.

Course Curriculum

Class 1: Orientation Session

Class 2: Foundations of Banking Law and Loan Structures

Introduction to banking law

Nature of security and guarantees

Events of Default (EoD)

Regulatory landscape (RBI, SEBI, etc.)

Applicable laws (BR Act, RBI Act, TPA, PMLA, etc.)

Class 3: Anatomy of a Loan Agreement

Components of a financing transaction

Structure and key clauses of loan agreements

Operational mechanics

Key obligations of borrowers and lenders

Transfer of loans, costs, indemnities, taxes

Boilerplate clauses (Notices, Confidentiality, Severability, etc.)

Class 4: Representations, Covenants, and Events of Default

Understanding representations and warranties

Negotiation strategies and legal considerations

Covenants (affirmative, negative, financial)

Events of default: Triggers, consequences, and negotiations

Role of amendment and waiver clauses

Class 5: Security Creation, Perfection, and Registration

Legal concepts of mortgage, hypothecation, pledge

Types of mortgages under TPA, 1882

Fixed vs floating charges, pari passu, subservient rights

Negative lien and legal validity

Stamp duty, registration, and perfection requirements

Consequences of non-registration

Class 6: External Commercial Borrowings (ECB)

Overview of ECB framework under FEMA and RBI

Recognized lenders and eligible borrowers

Pricing, tenure, and end-use restrictions

Hedging requirements and key filings

Security creation in cross-border loans (ECB + ODI/FDI)

Prepayment, restructuring, and transaction structures

Governing law and jurisdiction clauses in ECBs

Class 7: Non-Convertible Debentures (NCDs) and Project Finance

What is a debenture?

Listed vs unlisted NCDs

Stamp duty, issue, and allotment

Regulatory compliance (SEBI, Companies Act)

Project finance: Overview and structure

Security packages in infrastructure finance

Documentation, consents, and approvals

Class 8: Trade Finance & Securitization

Introduction to trade finance (domestic and cross-border)

Buyer’s credit, supplier’s credit, factoring

Export/import advance and APSAs

Securitisation: Purpose, benefits, and legal framework

Role of SARFAESI, SEBI, and RBI guidelines

Key players: Originator, SPV, investors

Asset pooling, PTCs, and regulatory filing

Class 9: Real Estate Finance and Enforcement Frameworks

Legal structure of real estate project finance

Residential, commercial, and mixed-use projects

Warehouse and logistics finance

Structured funding in real estate

RERA, end-use regulations, permissions

Debt enforcement: SARFAESI, IBC, DRTs

Insolvency of borrowers: Resolution or liquidation

Final Q&A and assessment

Class 10: Concluding Session

Who Should Apply?

This course is designed to be accessible and beneficial to a wide range of learners and professionals interested in the legal and practical dimensions of banking and finance. It is ideal for Law Students and Graduates, Legal Professionals, & Finance and Compliance Professionals.

Career

- Boost in Career: Learning from the best experts in the field and use the knowledge and gain real-world experience.

- Career Opportunity: Use the skills to get hands-on experience through internships and jobs in the banking sector and explore other legal options in Finance.

Scope

This course can help you in knowing the intricacies apart from theory which is essential in the practical legal work. And apply in the vast field of Corporate Law, be a step ahead from the rest of the crowd.

Opportunities

Opportunities can be varied from Banking & Finance Associate, Regulatory Compliance Officer, Documentation & Contracts Specialist, Debt Restructuring Consultant etc., across various law firms and gain practical skills and hands-on experience from legal professionals and experts of this field.

Internship Opportunity

- Two months remote internship will be offered to eligible candidates with law firms and under practicing advocates.

- This internship aims to provide hands-on exposure to banking and finance law practice, including research, drafting, and client advisory assistance.

Internship Eligibility

- Participants who attend all live sessions and submit their assignments on time will be eligible to apply for internship opportunities.

- Internship offers are subject to vacancy and selection criteria set by partnering advocates, chambers, and law firms.

Mentors

Principal of School of Law at IIMT

Meerut

Mr. Pranav Jha

Mr. Pranav Jha was serving as a Junior Research Consultant at the National Human Rights Commission. He has completed his LL.M (Access to Justice) from Tata Institute of Social Sciences, Mumbai.

He has graduated in Law- {B.A.LL.B (Hons.)} with distinction from Aligarh Muslim University, Murshidabad Centre (W.B). He has been very dedicated to his academic excellence. He was a student representative at CDFC, TISS.

Perks

- E-Certificate on Completion

- Internship Opportunity

- Letter of Recommendation

Contact Us

- Call: 9458479236

- Mail: contact.lra24@gmail.com

- Address: D2, New Friends Apartment, Sir Syed Nagar, Aligarh, Uttar Pradesh, India. Pin-202001.

- Our testimonial