The Pros and Cons of Gen Z's Love Affair with Credit Cards

The Zoomers, or Generation Z, are a group of people who are now dictating or changing the driving force of the world. Gen-Z is usually referred to as the group of people who are estimated to have been born between mid-1990 and mid-2012.

While there are multiple positive characteristics that have been embedded in Gen-Z when compared with other previous generations, there are those that cause more damage than good. One such characteristic that has been called into question is Gen-Z’s consumer culture.

Gen-Z, typically regarded as a socially conscious generation, often forces themselves to follow the latest trends in order to fit into the style and definition of their social groups. This often leads to excessive and unnecessary spending, for which the easiest form of temporary financing for such lavish desires is an ‘a credit card.’

‘Credit cards’ are the go-to way for most people, not just Gen-Z, to spend money and worry about the consequences later. According to a study conducted by morning consult in 2023, more than 30% of Gen Z adults in the U.S. have credit card debts. The driving force behind the increased use of credit cards among Gen-Z is due to various factors.

The lack of financial literacy amongst Gen-Z has been a cause of concern for a long time. Most members of the Gen-Z group fail to understand the core concepts about the workings of a credit card, such as credit charges, interest rates, and more. The lack of education about finances and money management through formal education has been criticised for the deficiency.

With the rise of the internet and social media along with it, the internal need of one to look for approval from others through digital platforms by spending uncontrollably has compelled Gen-Z, especially teens, to cave into the dark pit of swiping cards. Consumer-based companies often view this as an opportunity and pump out more colourful and pleasing products with the intent of furthering the social demand for such products.

The uncontrollable usage of credit cards leads to credit card debt, which often spirals out of control if not managed thoroughly due to high-interest rates and fees that add up quickly. For a young adult who is regarded as belonging to Gen-Z, this could put them in a maze of unending payments.

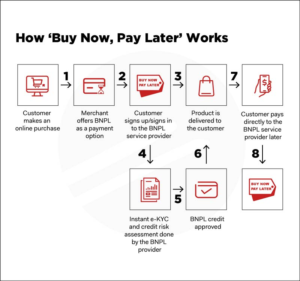

Modern credit cards offer options such as ‘buy now, pay later’ or instalments, which attract the eye for the moment but in the long run cause severe consequences due to overspending and forcing one to live beyond their means. As a result of this, young adult is forced to drain out their minimal savings as a last resort, further depleting their means of subsistence.

Once the debt builds up, it becomes more and more difficult to cope with the payments, which leads to delayed payments. This consequently affects the credit score of a young adult and makes it more difficult to attain loans or credit in the future.

It is important to acknowledge that although 30% of Gen-Z adults are in credit card debt, this is comparatively better than the figures for millennials, Gen Xers, and baby boomers, in which 40% of people are in credit card debt. Therefore the message of maintaining healthy credit card practices is being imparted to younger in a better rate than before.

It is essential for one to keep good credit card habits, not just to keep up with the already owed payments but also because one must be aware that there are pros to using credit cards if they are used the right way.

Keeping a positive credit score can help a young adult secure loans in the future. A good credit score is an indicator of healthy financial management capabilities, which convinces a lending institution.

Keeping up with monthly payments further extends the benefits in the form of rewards. These rewards can be in the form of cashback, points, or other incentives for purchases they make, further allowing them to save money, contrary to the general notion of having a credit card.

Although, when looking at the statistics, it is obvious that Gen-Z has been keeping up with healthier credit card practices than other generations, there is still a long way to go before one can be completely satisfied with the statistics. Therefore, it is important to educate the young minds of today, or the Gen-Z, on the importance of healthy credit card practices.

Lessons on healthy financial practices, taxes, credit cards, and other topics are more important than ever. Schools and other educational institutions should consider teaching such financial-related topics to guarantee that young minds are taught to handle money and finance from an early age.

The role of parents is just as important as the role of educational institutions in educating their children about healthy financial practices. Children often take note of the practices of their parents and implement those practices in their own lives; hence, it is necessary to portray healthy financial practices in front of them. It is important to be certain that one’s child has the responsibility and capability to practice healthy credit card habits before handing them one.

Credit card usage among Gen Z is becoming more prevalent as this generation grows up and gains more financial independence. It is essential for Gen Z to understand the potential risks and consequences associated with credit card usage.

It is also important that Gen Z know that they can leverage credit card rewards programmes to their advantage and enjoy the benefits of responsible credit card use. By taking control of their finances and adopting healthy credit card practices, Gen Z can pave the way for a financially secure future.